How Corporate Profits Are Killing The Economy

The Article: Corporate Profits Are Eating the Economy by Derek Thompson in The Atlantic.

The Text: Here are two things that are true about the economy today.

(1) The Dow Jones industrial average is poised to set a new record as corporate profits stretch to all-time highs.

(2) There are still fewer working Americans today than there were before the start of the Great Recession.

The fact that these two things can be true at the same time might outrage you. But it shouldn’t surprise you. In the last 30 years, there has been a great divergence between growth and workers’ incomes, as the New York Times reminds us today. Corporate profits have soared, in the last decade especially, particularly because of three things: Globalization has pushed down the cost of labor available to multinational corporations; technology has allowed companies to make more with fewer workers, in general; and Big Finance has gobbled up the economy, as the banks’ share of total corporate profits has tripled to about one-third since the middle of the last century, according to Evan Soltas.

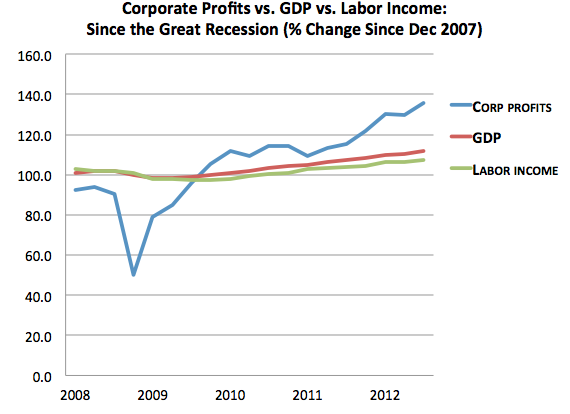

Here’s the short story of corporate profits, GDP, and workers’ income since the Great Recession. As you can see, corporations rode a wild roller coaster, but they quickly found their way back on top. GDP has been sluggish and overall labor income has struggled to keep up with even that sluggish pace.

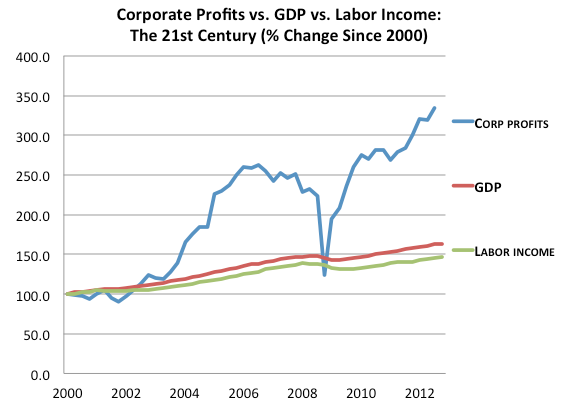

Here’s the longer view. Zoom out to the turn of the century, and you can see that this isn’t a “recession” trend. It’s just a trend that the recession has amplified. Corporate profits starting eating the economy around 2003, around the time the housing market started delivering massive profits to finance companies.

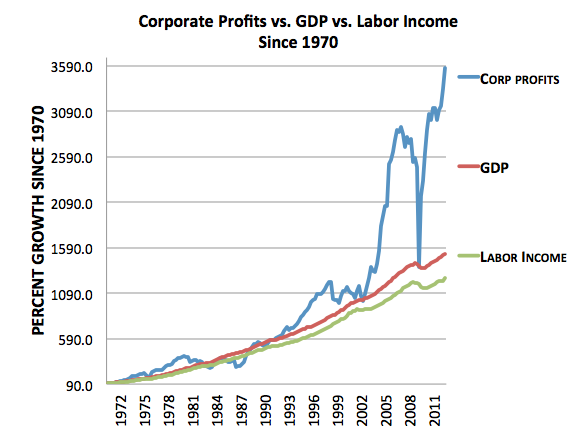

And the even longer view. Zoom out to 1970, and you can see that corporate profits started to take off, relative to GDP growth, in the 1990s, before exploding in the last decade.

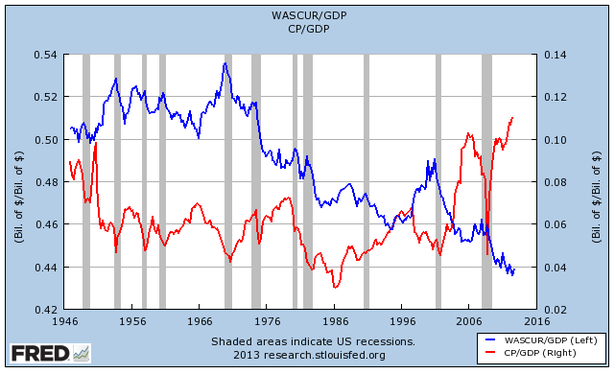

For another look at the long story, here’s a graph that compares labor’s share of the economy (BLUE) to corporate profits’ share of the economy (RED). There has been a steady shift away from workers toward capital since the early 1970s but the real action comes around 2000. Corporate profits double their bite of the economy and labor’s share, already at a post-WWII low, falls another four percentage points steeply.

Taken together, these graphs don’t tell us that corporations have utterly decoupled from the economy. When the economy crashes, we all crash together: corporate profits, employment, and growth. But when the economy recovers, we don’t recover together. Corporations rack up historic profits thanks to strong global demand, cheap global labor, and low interest rates, while American workers muddle along, their significance to these companies greatly diminished by a worldwide market for goods and people.

A growing economy and lower unemployment should eventually give U.S. workers a long-deserved raise (and so should rising labor costs overseas that persuade more companies to hire domestically). But improvements in technology and the ability of companies to hire locally as they chase worldwide demand are just two factors that should restrain any optimism we can keep corporate profits from gobbling up more and more of the economy. Workers still need help — and they certainly won’t find it in the sequester.