Posted on July 13, 2009 in

Images With the current economic climate, there has been much discussion about the origins of the financial crisis and the future of capitalism. In these typically hollow debates, Adam Smith is routinely and thoughtlessly invoked as the founder of modern capitalist though, based on unrestrained trade, limited government, and the mechanics of market economies. To this day, The Wealth of Nations is held up as the espousal tome for free-market ideology that decries government regulation, excessive taxation, and wealth redistribution (in whatever contrived shapes it may take).

But the myth of Adam Smith created by two centuries of advanced industrialization and capitalism is very far from the reality of Adam Smith. The majority of academics and pundits alike generalize on Smith’s observations about the invisible hand, the benefits of division of labor, and the growth of wealth through free trade.

Outside of these points, The Wealth of Nations serves as an of his time reaction to the impact of corporations and mercantile interests on economies and governments. More specifically, Smith spent much of his book reacting to the growth of the East India Company, whose stockholders were to be found on every level of government decision making in Great Britain and thought to be adversely effecting foreign policy and internal financial systems. Smith was also appalled at the exploitation under the reign of the East India Company, including the starvation of over 30 million people in modern-day Bangladesh due to British-imposed tariffs.

As Chomsky notes, Smith saw the East India Company and other stockholding corporations as bending state policy towards the good of the few at the expense of the many. Smith to this end was in favor of heavy-handed government regulation to prevent financial and corporate powers from manipulating government policy for their own ends. This led him to conclude on the nefarious impulse of corporate manipulation, that when “People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public, or in some contrivance to raise prices. It is impossible indeed to prevent such meetings, by any law which either could be executed, or would be consistent with liberty and justice. But though the law cannot hinder people of the same trade from sometimes assembling together, it ought to do nothing to facilitate such assemblies; much less to render them necessary.”

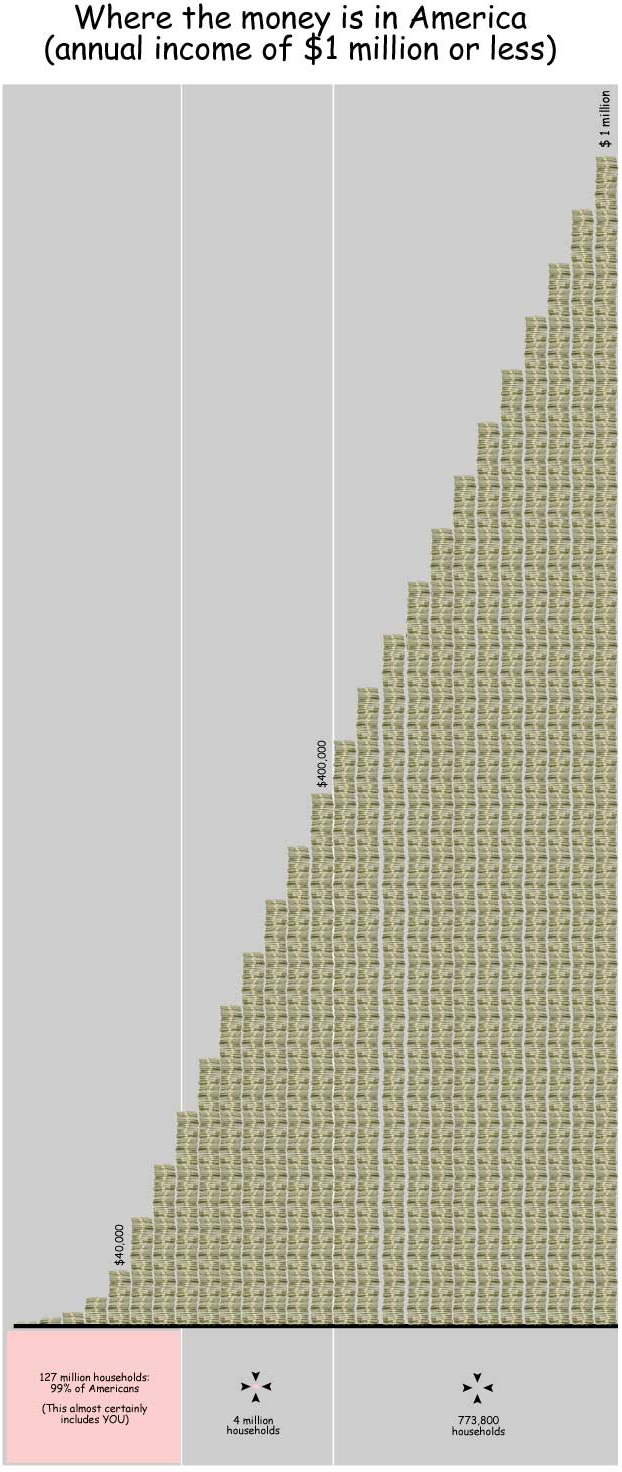

The legacy of Smith continues to diverge further and further from the reality of Smiths principles which were heavily influenced by Rousseau and other humanist figures of the Enlightenment. Smith advocated for a system of progressive taxation and a political economy centered on the freedom of creative pursuits but protective of the working class. Considering how his legacy is enshrined today, it seems out of place to realize that Smith’s chief concern was for economic policy to be secondary to moral and ethical concerns such as economic equality, freedom of speech, and dignified and just labor conditions.

See Also: Was Adam Smith a liberal?, Justin Fox’s new book: ‘Myth of the Rational Market’, “The Hottest Places in Hell are Reserved for Those Who, in Times of Moral Crisis, Maintain a Neutrality”, How the financial crisis has killed the governance reform agenda, A Fleecing Of The Sheeple, Another Comment on Bonuses and Benchmarks, Taking Stock: Economy and Government, and Now Lemme Tell You A Story, The Devil He Has a Plan.

[tags]adam smith, the wealth of nations, free markets, economics, capitalism, taxation, government regulation, evaluating smith’s legacy, what adam smith really believed, political economy, corporate influence, government[/tags]