Just Know I’m Just Like You

Colours by Grouplove off of Never Trust a Happy Song.

Colours by Grouplove off of Never Trust a Happy Song.

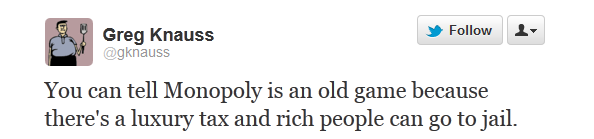

That and the bank doesn’t foreclose all of your homes.

The Article: Iraq: The Gloves Come Off by Robert Grenier in Al-Jazeera

The Text: I must confess I didn’t see it coming.

Yes, Iraq’s Prime Minister Nouri al-Maliki has always shown autocratic tendencies, unsurprisingly given the traditional political role models with which Iraqis are working. And yes, he has long over-centralised security power in his own hands, maintaining personal control over the Interior, Defence and National Security Ministries and making the Baghdad Operations Command directly answerable to his personal office. But this, too, is not entirely unexpected, given the tenuousness of Iraqi internal security.

And finally, yes, Abu Isra has been transparently uncomfortable in sharing any authority with the Iraqiyya bloc, the largest vote-getter in the last elections, and has essentially reneged on many of the elaborate power-sharing arrangements reached in the so-called Irbil accords, which facilitated formation of his government. But again, here too, Maliki has not been entirely outside his rights. He did, after all, form the most viable parliamentary coalition, giving him the right to form a government, and the vague provisions for an extraordinary National Security Council to be chaired by his chief political rival, and to which key domestic and national security policies were to be referred, were simply never realistic.

Now, however, only days after the final withdrawal of American troops, it is clear that al-Maliki has finally gone too far. His recent actions have served to strip the veneer of legitimacy from his past policies, and have revealed those past actions as the precursors to a naked power-grab. Beginning with the sudden and summary arrest of some 615 alleged Baathists, including many of Maliki’s political enemies and conducted while the final push to evacuate the last of the US troops was conveniently underway, the Iraqi prime minister has gone on to press politically-motivated terrorism charges against Vice-President Tariq al-Hashemi, a Sunni Islamist and a prominent member of Iraqiyya. At the same time, the Shia Maliki has moved to orchestrate a parliamentary no-confidence vote to oust Sunni deputy Prime Minister Saleh Mutlaq, another prominent member of Iraqiyya, ostensibly over a personal slight. Other political opponents have awakened to find tanks around their homes.

The upshot is that Hashemi has now sought asylum in Iraqi Kurdistan, against whose leaders Maliki is now making vague threats. In the face of Iraqiyya’s predictable walkout from the Council of Representatives (CoR) and boycott of the cabinet, Maliki is threatening to replace its ministers with interim appointments lacking CoR approval. And in response to Sunni-majority Diyala province’s stated desire to seek protection from the current wave of politically-motivated arrests through formation of an autonomous region – which is permitted under the Iraqi constitution – the rogue prime minister vows to unleash “rivers of blood”.