Why The 1% Should Pay Tax At 80%

The Article: Why the 1% should pay tax at 80% by Emmanuel Saez and Thomas Pinketty in The Guardian.

The Text: In the United States, the share of total pre-tax income accruing to the top 1% has more than doubled, from less than 10% in the 1970s to over 20% today (pdf). A similar pattern is true of other English-speaking countries. Contrary to the widely-held view, however, globalisation and new technologies are not to blame. Other OECD countries, such as those in continental Europe, or Japan have seen far less concentration of income among the mega rich.

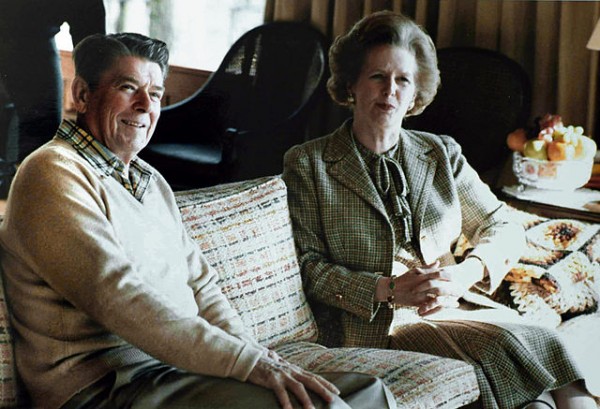

At the same time, top income tax rates on upper income earners have declined significantly since the 1970s in many OECD countries – again, particularly in English-speaking ones. For example, top marginal income tax rates in the United States or the United Kingdom were above 70% in the 1970s, before the Reagan and Thatcher revolutions drastically cut them by 40 percentage points within a decade.

At a time when most OECD countries face large deficits and debt burdens, a crucial public policy question is whether governments should tax high earners more. The potential tax revenue at stake is now very large.

For example, doubling the average US individual income tax rate on the top 1% income earners from the current 22.5% level to 45% would increase tax revenue by 2.7% of GDP per year – as much as letting all of the Bush tax cuts expire (only a small fraction of them lapsed in January 2013). But of course, this simple calculation is static: such a large increase in taxes may well affect the economic behaviour of the rich and the income they report pre-tax, the broader economy and, ultimately, the tax revenue generated. In recent research, we analyse this issue both conceptually and empirically using international evidence on top incomes and top tax rates since the 1970s.

There is a strong correlation between the reductions in top tax rates and the increases in top 1% pre-tax income shares, for the period from 1975-79 to 2004-08, across 18 OECD countries for which top income share information is available. For example, the United States experienced a 35 percentage-point reduction in its top income tax rate and a very large ten percentage-point increase in its top 1% pre-tax income share. By contrast, France or Germany saw very little change in their top tax rates and their top 1% income shares during the same period.

So, the evolution of top tax rates is a good predictor of changes in pre-tax income concentration. There are three scenarios to explain the strong response of top pre-tax incomes to top tax rates; each has very different policy implications.

First, higher top tax rates may discourage work effort and business creation among the most talented: the so-called supply-side effect. In this scenario, lower top tax rates would lead to more economic activity by the rich and hence more economic growth. If all the correlation of top income shares and top tax rates seen in the above data were due to such supply-side effects, the revenue-maximising top tax rate would be 57%. This would imply that the United States still has some leeway to increase taxes on the rich, but that the upper limit has already been reached in many European countries.

Second, higher top tax rates can increase tax avoidance. In that scenario, increasing top rates in a tax system riddled with loopholes and tax avoidance opportunities is not productive either. A better policy would be to first close loopholes so as to eliminate most tax avoidance opportunities, and only then increase top tax rates. With sufficient political will and international co-operation to enforce taxes, it is possible to eliminate most tax avoidance opportunities, which are well documented. Then, with a broad tax base offering no significant avoidance opportunities, only real supply-side responses would limit how high top tax rate can be set before becoming counter-productive.

In the third scenario, while standard economic models assume that pay reflects productivity, there are strong reasons to be sceptical, especially at the top of the income distribution where the actual economic contribution of managers working in complex organisations is particularly difficult to measure. Here, top earners might be able to partly set their own pay by bargaining harder or influencing compensation committees.

Naturally, the incentives for such “rent-seeking” are much stronger when top tax rates are low. In this scenario, cuts in top tax rates can still increase top income shares, but the increases in top 1% incomes now come at the expense of the remaining 99%. In other words, top rate cuts stimulate rent-seeking at the top but not overall economic growth – the key difference with the first, supply-side, scenario.

To tell these various scenarios apart, we need to analyse to what extent top tax rate cuts lead to higher economic growth. Again, data show that there is no correlation between cuts in top tax rates and average annual real GDP-per-capita growth since the 1970s. For example, countries that made large cuts in top tax rates, such as the United Kingdom or the United States, have not grown significantly faster than countries that did not, such as Germany or Denmark.

What that tells us is that a substantial fraction of the response of pre-tax top incomes to top tax rates may be due to increased rent-seeking at the top (that is, scenario three), rather than increased productive effort.

Naturally, cross-country comparisons are bound to be fragile; exact results vary with the specification, years, and countries. But the bottom line is that rich countries have all grown at roughly the same rate over the past 30 years – in spite of huge variations in tax policies. By our calculations about the response of top earners to top tax rate cuts being due in part to increased rent-seeking behaviour and in part to increased productive work, we find that the top tax rate could potentially be set as high as 83% (as opposed to the 57% allowed by the pure supply-side model).

Until the 1970s, policy-makers and public opinion probably considered – rightly or wrongly – that at the very top of the income ladder, pay increases reflected mostly greed rather than productive work effort. This is why governments were able to set marginal tax rates as high as 80% in the US and the UK. The Reagan/Thatcher revolution has succeeded in making such top tax rate levels “unthinkable” since then.

Now, however, we have seen decades of increasing income concentration that have brought about mediocre growth since the 1970s. And with the Great Recession that was triggered by financial sector excesses, a rethink of the Reagan and Thatcher revolutions is underway.

The United Kingdom increased its top income tax rate from 40% to 50% in 2010, in part to curb top pay excesses. In the United States, the Occupy Wall Street movement and its famous “We are the 99%” slogan also reflects a view that the top 1% has gained at the expense of the 99% – a view endorsed by our findings about the highly unequal distribution of income gains during the recovery.

In the end, the future of top tax rates depends on what the public believes about whether top pay fairly reflects productivity or whether top pay, rather unfairly, arises from rent-seeking. With higher income concentration, top earners have more economic resources to influence both social beliefs (through thinktanks and media) and policies (through lobbying), thereby creating some “reverse causality” between income inequality, perceptions, and policies.

The job of economists should be to make a top rate tax level of 80% at least “thinkable” again.