Does The US Economy Actually Do Better Under Democrats?

The Article: The U.S. economy does better under Democratic presidents — is it just luck? by Brad Plumer in The Washington Post.

The Text: Since World War II, there’s been a strikingly consistent pattern in American politics: The economy does much better when a Democrat is in the White House.

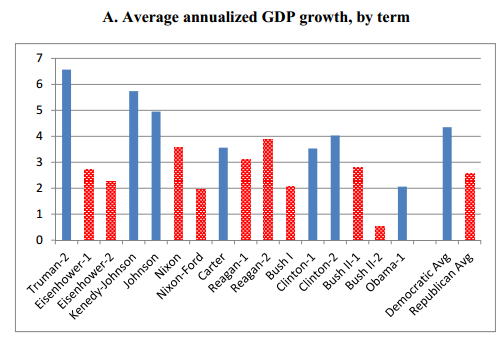

More specifically, since 1947, the U.S. economy has grown at an average real rate of 4.35 percent under Democratic presidents and just 2.54 percent under Republicans:

Why the big gap? One possible explanation is that Democratic policies are better for economic growth. Another is that Republican policies are better for growth — but there’s a time lag, so Democrats tend to benefit.

Alternatively, perhaps Democrats simply have better economic luck. That third theory is one favored by economists Alan Blinder and Mark Watson in their new working paper, “Presidents and the Economy: A Forensic Investigation”. They argue that random economic fluctuations best explain the differences in growth between 1947 and 2013, and not which party happens to hold the White House.

“Democrats would no doubt like to attribute the large D-R growth gap to better macroeconomic policies, but the data do not support such a claim,” the authors write. (Blinder worked as an adviser in the Clinton White House, Watson is an econometrician not affiliated with either party.)

Instead, the two economists offer three big reasons for the partisan gap in growth rates: oil shocks, productivity growth and consumer confidence. These factors, they say, can explain at least half of the gap. Here’s a breakdown:

1) Oil shocks: Republicans have had worse luck with oil shocks, or spikes in the price of crude oil that tend to cramp consumer spending and limit growth. Blinder and Watson draw on University of California, San Diego economist James Hamilton’s work on how oil spikes hurt the economy and suggest that these shocks explain between one-eighth and one-fourth of the difference in partisan growth rates.

They do note, however, that this isn’t entirely independent of policy, as the invasions of Iraq under Presidents George H.W. Bush and George W. Bush appeared to have driven up the worldwide price of oil. (The latter, the authors say, was “the biggest oil shock in the sample,” with a bigger economic impact than either of the OPEC-driven shocks under Presidents Richard Nixon and Jimmy Carter.)

2) Productivity shocks: Total factor productivity has tended to grow faster under Democratic presidents than Republican ones. The big story here was a surge in productivity during the John F. Kennedy and Lyndon Johnson administrations, combined with a sharp slowdown during President Ronald Reagan’s first term.

“As with oil shocks, we consider [productivity shocks] as mainly reflecting luck,” the authors write. “But, of course, we cannot rule out that they have a policy component as well.”

3) Consumer confidence: Consumer confidence tends to leap during the first year of Democratic presidencies. Is this a coincidence? The authors say it’s possible that the election of a Democratic president somehow boosts confidence, which in turn boosts spending. But it’s surprisingly difficult to tease out why this might be.

“Much of the D-R growth gap in the United States comes from business fixed investment and spending on consumer durables,” the economists write. “And it comes mostly in the first year of a presidential term. Yet the superior growth record under Democrats is not forecastable by standard techniques, which means it cannot be attributed to superior initial conditions.”

All told, the economists suggest that the three factors above account for 46 percent to 62 percent of the gap. That means we still don’t have a full answer.

Other (rejected) theories: The authors also consider — and rule out — a number of other possible explanations:

— Deficits. There doesn’t seem to be a huge difference in fiscal policies between the two parties since 1947. The structural federal budget deficit has been 1.5 percent under Democratic presidents and 2.2 percent under Republicans — “far from statistically significant,” the economists write.

— Military spending. The authors do find a big difference in military spending — real defense spending grew 5.9 percent under Democrats and just 0.8 percent under Republicans. But they don’t think this is enough to drive the difference in growth rates: “On average, federal defense spending accounts for just 8% of GDP over the postwar period. It would be hard for a tail that small to wag such a big dog.”

— Congress. Party control of Congress doesn’t seem to have much impact on the economy one way or the other.

— Federal Reserve. Fed chairmen appointed by Democrats tend to outperform Fed chiefs appointed by Republicans. But this doesn’t necessarily benefit Democratic presidents. Indeed, the Federal Reserve, on average, tends to lower interest rates during Republican administrations and hike them during Democratic administrations. (This might simply be a response to the fact that the economy does better under Democrats, however.)

— Inherited economies. The authors don’t give much credence to the idea that Democratic presidents inherit stronger economies. In fact, the opposite may be true: “Democrats inherit growth rates of 1.8% from the final year of the previous term, while Republicans inherit a growth rate of 4.1%.” Yet Democratic presidents have still done better, on average, in their first terms since 1947.

— Global patterns. There doesn’t seem to be any worldwide pattern here. Canada shows the same partisan gap in growth rates as the United States, with the economy growing faster under Liberal governments than during Conservative governments. But there’s no such pattern found in France or Germany.

Now, this paper is hardly the last word on the subject. As Blinder and Watson note, they can only explain from 46 percent to 62 percent of the difference in growth rates — there’s a lot more work to be done in figuring out the rest of the answer. “The rest remains, for now, a mystery.”

Further reading: Princeton political scientist Larry Bartels has also shown that income inequality tends to rise under Republican presidents and fall under Democratic presidents. Blinder and Watson mention this fact in their paper, but they don’t examine whether this might relate at all to the partisan gap in growth rates.