The Tax Payer Pays The Big Banks Bonuses

Every year when I pay my taxes, I always hope that government money will be used by predatory banks to enrich their executives at my expense! And it looks like my hopes finally came true:

Citigroup Inc., one of the biggest recipients of government bailout money, gave employees $5.33 billion in bonuses for 2008, New York’s attorney general said Thursday in a report detailing the payouts by nine big banks.

The report from Attorney General Andrew Cuomo’s office focused on 2008 bonuses paid to the initial nine banks that received loans under the government’s Troubled Asset Relief Program last fall. Cuomo has joined other government officials in criticizing the banks for paying out big bonuses while accepting taxpayer money.

Citigroup, which is now one-third owned by the government as a result of the bailout, gave 738 of its employees bonuses of at least $1 million, even after it lost $18.7 billion during the year, Cuomo’s office said. [via AP]

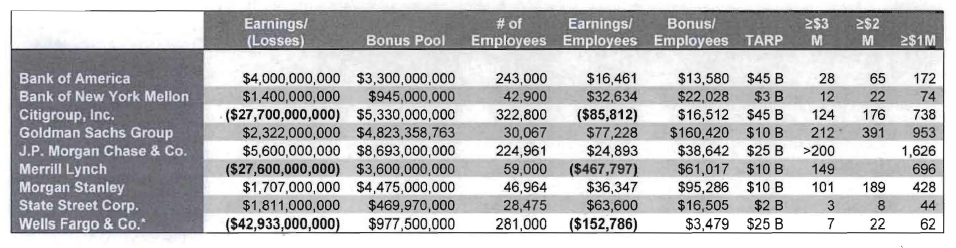

Think that’s bad? Check out the full statistics below of banks that received TARP bailout funds and the bonuses they handed out:

All totaled, over $34 billion in bonuses were given out by banks during the financial crisis, or even though the banks lost over $80 billion and took over $175 billion in federal bailout funds via the TARP program. Bonuses thus constitute 20% of the bailout money received and almost half of the banks loses during this period.

Yes, you read that correctly: Banks lost over 80 billion dollars, took over 175 billion dollars in taxpayer bailouts, and yet still handed out 34 billion dollars in corporate bonuses. And to add salt in the wounds, Visa profits jumped 73% the last quarter! Who needs credit card reform or bank regulations anyway?

See Also: Big Banks Give $5.33 Billion In Bonuses, On Q2 Bank Earnings, It’s Still Good To Be A Banker, Bankers’ Bonuses, Bailouts are Bad, $33 Billion in Taxpayer Money Subsidized Wall Street Bonuses, and Bonuses exceeded profits at bailed-out firms.

[tags]bank bonuses, goldman sachs, wells fargo, citigroup, wachovia, bank of america, Troubled Asset Relief Program, TARP program, corporate bonuses, executive bonuses, taxpayer, tax payer, BOA, investment banks, public money, public bailout, federal bailout, taxpayer money, federal funds, 2008, 2009, wall street[/tags]

After spending a week and a half with bankers, this crucifixion of their positions is bullshit. Bonuses are a necessity and have played out an integral role in the world of banking for a long time. Bonuses are used by banks to maintain loyalty amongst their ranks. Jobs in the banking world are much more liquid than most and in order to remain competitive, banks must have the best bankers available to them. In order to keep them working for them instead of the other guy, bonuses are paid out. Instead of using the word bonus, try using a more accurate term, like “keep-you-working-for-us payment”

How the fuck could you ever call a bonus a necessity?