Posted on July 18, 2009 in

Articles One of the highly entertaining aspects of Sonia Sotomayor nomination and confirmation process has been the constant refrain of “Affirmative Action” pushed by conservatives as they seek to undermine Sotomayors reputation. You see, in conservative circles, affirmative action is synonymous with a person of color getting a job that they didn’t deserve (when there is probably a much more qualified White Male available!).

Apart from being laughable given Sotomayors extensive judicial experience and readily apparent intellectual discipline, conservatives seem to have a comically short-term memory in relation to their own less-than-qualified picks for the Supreme Court. Or, in short, Clarence Thomas.

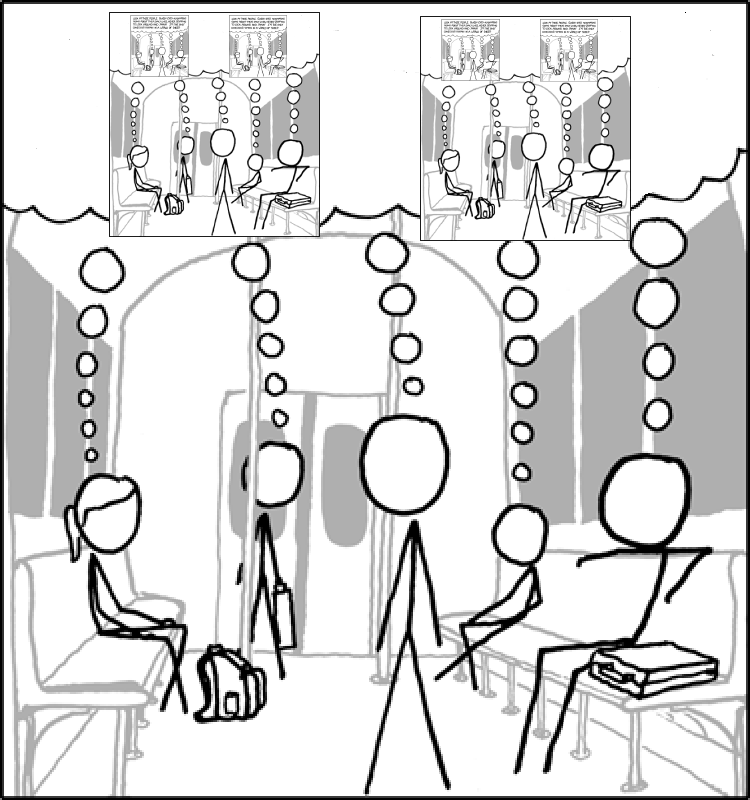

I’m not necessarily saying Clarence Thomas was selected by George H.W. Bush for the Supreme Court because he was black. But I am saying Clarence Thomas has been an embarrassment to the Supreme Court for his 18 years on the Supreme Court, displaying a complete lack of even basic understanding of Constitutional Law and repeatedly falling asleep during oral arguments on some of the most important constitutional and civil right cases of the past 2 decades. Incidentally, Sotomayor was appointed by H.W. Bush to the U.S. District Court for the Southern District of New York around the same time Thomas was appointed to the Supreme Court.

The simple question is Independent of personal background, is Sotomayor qualified for the Supreme Court?, and the answer to that question is a resounding yes. Pose the same question about Clarence Thomas, and the answer is a resounding no.

See Also: Sonia Sotomayor and Affirmative Action, If You Got A Racist Mind, Uncle Pat on MSNBC: America is “a country built basically by white folks”, Stop It, “Affirmative Action Increases Diversity by Discriminating Against White Men”, Pat and Sonia, On Sotomayor And White Privilege, Judging Sonia Sotomayor?, and The 5 Most Racist Moments of the Sotomayor Confirmation Hearings.

[tags]Sonia Sotomayor, sotamayor, supreme court, affirmative action, reverse racism, clarence thomas, conservatives, qualifications for supreme court nomination, confirmation, republicans[/tags]